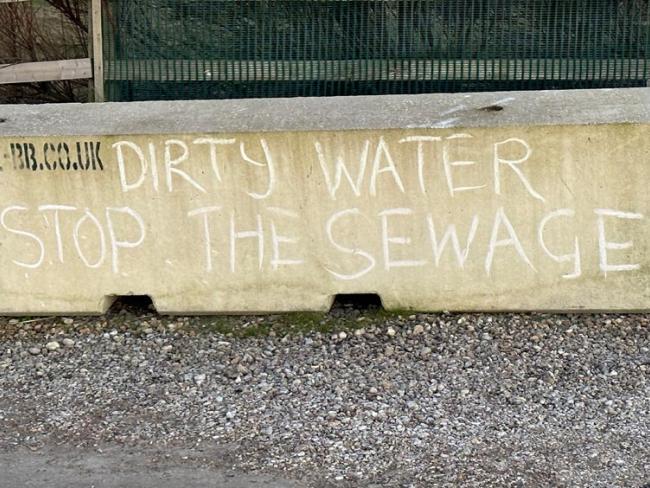

Slogan by the seafront of a Sussex seaside town. Photo Workers.

The Labour government’s new water bill is a fraud. It will do nothing about the debt that continues to hamstring the industry. And nothing, either, about the blatant failure to maintain minimum environmental standards…

The water industry is a mess, laden with post-privatisation debt and failing spectacularly on environmental standards.

Various local and national groups have campaigned for clean water for several years, without yet forcing the industry to change. The new government faces further pressure with a March for Clean Water in London on Sunday 3 November.

In early September, environment secretary Steve Reed made big claims for the new Water (Special Measures) Bill. He said he would jail the chief executives of water companies who obstruct investigations into spillages, and would ban bonuses for the directors of companies which don’t meet environmental, consumer and financial guidelines.

These measures sound dramatic, but don’t seem to trouble water company CEOs. Feargal Sharkey, former musician and now fearless champion for clean water, observed, “All of these measures are already included in the existing laws, which could be enforced with vigour and enthusiasm.”

Superfluous

Reed made much of a promised government review into how water companies operate – but definitively ruled out nationalisation. A review or more “awareness” of problems are superfluous. The scandalous state of the industry and what lies behind it is already well known.

Instead of relying on a government wedded to token gestures and ineffective regulators, workers need to take actions necessary to force solutions to the industry’s problems.

Analysis by campaign group “We Own It” shows that over 30 per cent of the money collected from water bills goes to shareholders as dividends (11 per cent) and to servicing debts (20 per cent).

Thames Water, the largest of the water companies, provides a shocking example of greed and incompetence. It has run up £18 billion of debt; its cash reserves are due to run out by next May.

The industry regulator, Ofwat, has put Thames Water into a “special measures” regime. This does not mean customers’ money will be invested in stopping sewage discharge into our rivers. Nor does it mean an end to paying huge dividends.

It means only that the company must regularly report on its spending programme, and must show improvements in its performance, its delivery of investments, and its balance sheet, in order to exit the regime.

The last point is crucial. If the company fails to raise new funds from new investors it could result in temporary nationalisation with most of its debts transferred to the state.

Thames and its ultimate owners don’t accept Ofwat’s criticism. Under pressure to reduce debt levels and to attract investment, they want Ofwat to agree increases to customer bills of over 50 per cent, more than the regulator was prepared to allow.

And to top that, the owners are pitching for a write-off of fines for major spillages before they will bail out the company. Rather than fix the problems that led to the fines, they are challenging the regulator to not let the company fail – or if it does so, to leave the taxpayer with the debts.

Thames continues to make dividend payments despite its debt. In March 2024 the company’s board agreed to pay over £150 million in dividends – more than double its operating profit. The next day, its investors said that they would not inject £500 million cash support previously pledged.

Ofwat was already looking at whether a dividend of £37 million in December 2023 broke regulatory rules. The line from Thames has been all along that it is not “paying dividends to external shareholders”, merely paying a dividend to another company in the group to help it pay its debts – and that is set to continue. This looks like Thames is daring the regulator to do its worst.

On 11 July, Ofwat agreed that the water companies could put up the bills of 16 million households by 22 per cent over the next five years. Chancellor of the Exchequer Rachel Reeves called these rises “a bitter pill” for households, but said nothing about blocking them.

The government is helping water companies to increase consumer bills. These, and the resulting increased profits and dividends, will all happen quickly. The companies behind the privatised industry in England and Wales – 70 per cent of which are foreign-owned – will have their ill-gotten gains.

The promised new investment and improved standards will be more elusive. Increased water bills force the British people to bail out failed private finance.

‘Obscene’ dividends

Matt Staniek, founder of the Save Windermere campaign, said, “It’s very clear that the water industry is exploiting the captured bill payers of this country and regulators are allowing it. Instead of allowing water companies to unfairly increase bills, Ofwat should halt these obscene dividend payments to shareholders. Labour’s actions so far have been inadequate, despite campaigning heavily on this issue before the election. This is a scam and now Labour are the ones permitting it.”

Paul Jennings, from the Ver Valley Society, said, “The investors in the water industry have blindsided the regulators. Elaborate financial structures have allowed billions to leak out of the system. The regulators did not see it happening. Poor performance by them and government.”

‘Thames’s owners want fines for major spills to be written off before they will bail out the company…’

The water companies were debt-free at privatisation by the Thatcher government over 30 years ago. Since then they have taken on over £60 billion of debt, while investors have taken out £85 billion in dividends and other payments. Water company executives have taken over £25 million in bonuses and incentives since 2019. Not investing is still profitable. Polluting still pays.

In 2018, Michael Gove estimated that between 2007 and 2016 the nine private water companies For England and Wales paid 95 per cent of their profits to shareholders. No government will stop the CEOs of companies from awarding themselves bonuses and dividends. Only popular control will do this. Nationalisation – taking the companies out of the control of capitalists interested only in profit – is part of the answer, but not the whole answer.

Scottish Water is a publicly owned company, but it isn’t free of sewage problems. Increased regulation is called for but that needs to be more effective – a reminder that nationalisation would only be a first step.

In August Thames, Yorkshire and Northumbrian Water were fined a total of £168 million for sewage discharges. And there have been many more. It should be clear by now that the regulatory regime is not helping to secure clean water in Britain.

Workers throughout the industry need to take the responsibility for improving their industry’s performance, as well as addressing immediate concerns. When workers avoid responsibility, disasters happen – as the Grenfell tragedy should have taught us all.

Water workers campaigned against privatisation of water in 1989, but they can’t now leave sorting out the industry to company CEOs or to Ofwat. They know that these bodies are not focused on doing a decent job.

Water workers themselves can speak out and help to resolve the interlinked issues of pollution, underinvestment and debt. Trade unions need to support all those taking responsibility for the good of their industry.

The March for Clean Water claims a wide variety of groups in support. But so far, neither the TUC nor any of the unions working in the industry, despite their concerns about infrastructure investment.

Correction

• This article, as it appears in the November/December edition of Workers, failed to acknowledge that the GMB union is supporting the march. The TUC and other trade unions are not doing so officially.