Members of the University and College Union (UCU) are currently being balloted over the employers’ latest proposals in the long-running university pensions dispute. The ballot opened on 4 April and will close on 13 April.

If the proposals are rejected, a further 14 days of industrial action will follow, biting deep into the exam and assessment period at the end of the academic year – on top of 14 days of strikes already since the fight began in February.

Brilliant

The political gains the University College Union workers have made so far in their brilliant response to the covert EU-led pension offensive have been tremendous.

The employers in Universities UK (UUK) declared in late 2017 that they needed to close the Universities Superannuation Scheme pension guarantee to future service and to replace it with a stock market related pension with no guarantees.

Following intense action by union members across Britain – their ranks swollen by thousands of new members – the UUK has now agreed that the scheme should continue with a future guaranteed pension promise.

But the offer leaves open a big question: Should the value of the current pension guarantee continue to accrue for future pensionable service, or should it be diluted?

To address this question the employers are proposing an “independent pension panel” to review how the scheme’s pension fund deficit has been arrived at.

EU interference

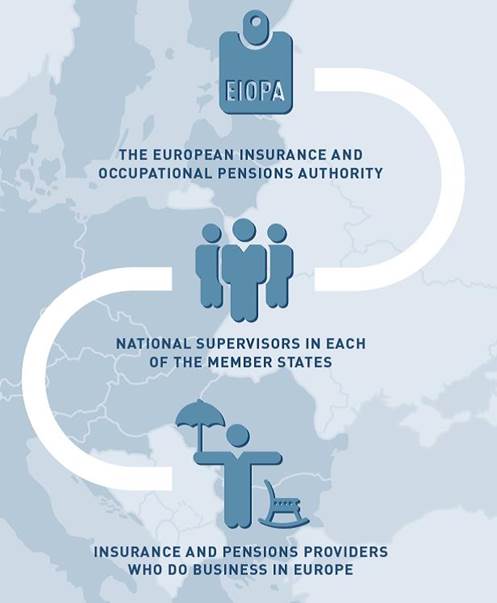

That deficit has fluctuated over time from £12 billion to £6.1 billion. How come? Only by studying the machinations of the EU’s EIOPA (the European Insurance and Occupational Pensions Authority) will University College Union workers be able to understand what has been happening to their pension, and what they have to do next.

The EU has prescribed the pension valuation method that must be used in all occupational pensions. In essence, it is disguised politics where the method is rigged to throw up a “shock and awe” deficit so that workers capitulate and give up on a meaningful pension guarantee.

‘Quite simply, the UCU must demand that the EU take its hands of the scheme.’

Quite simply, the UCU must demand that the EU, through the EIOPA, take its hands off the University Superannuation Scheme. The British Pension Regulator, which claims to run things, would then have nothing to hide behind – and neither would the new ‘Independent Pensions Panel’ being offered to the UCU to prevent further strikes.

The attacks on British workers’ pensions have been coordinated through the EIOPA and have been applied using a market-related method of pension valuation, introduced in 2000. The attacks continue apace and are now being rolled out to include Italy, Spain and Holland.

The key facets of the attack are the removal of pension guarantees through shifting to a defined contribution occupational pension structure; the stopping of indexing pensions above a certain income level of inflation; and increasing the retirement age to 67.

Independent?

The independent panel’s terms of reference are yet unclear but it will have an independent chair, with academics and “pension professionals” sitting on it. UUK Chief Executive Alistair Jarvis said, “I hope it [the panel] will give assurance that the valuation undertaken has been robust and boost public confidence in the process.”

Jarvis went on to say he anticipated the panel would provide greater transparency and clear up concerns over the calculations. In other words, he hopes that the panel will be tinkering with a set of financial assumptions within the perimeter set by the EU. The panel is therefore in danger of being akin to sheep trapped in a sheep’s pen.

To disguise this possibility the panel’s marketing message is likely to be “here is the domain of the expert, the people who know best” with their mesmeric calculative and quantitative skills. In this situation university workers will need to be much more conscious of the relationship between mathematical financial calculations and political process.

New method

To be consequential the panel will need to adopt a new method of valuing salary-linked pension guarantees totally independent of the EU calculation model. And during this process the university workers – “the ordinary folk” – will need to shake themselves from the ethos of letting others take social decisions for them.

None of this should put in the shade what the university workers have achieved so far. From Oxford to London, from Cardiff, Bristol and Glasgow they have been united in keeping the pension scheme open.

And apart from a preparedness to defend their occupational pension, the union’s national action has been a political sight that has terrified the petty separatists in government who want Britain to be broken up.