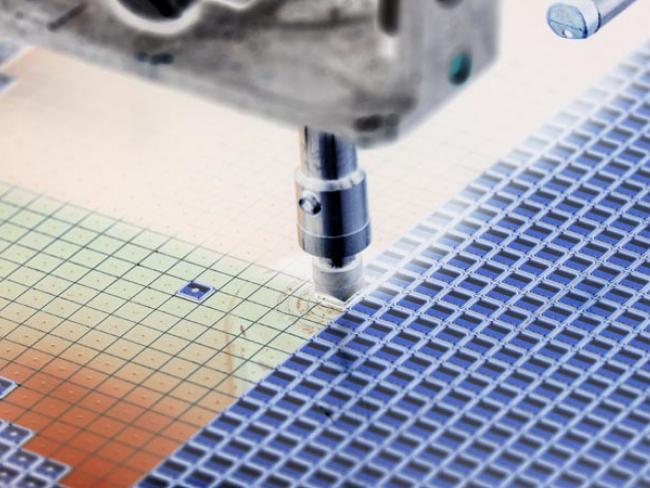

Manufacturing is key to real growth. Photo Macro Photo/shutterstock.com.

There is capital – plenty of it – that could be used for investment here in Britain but instead countless billions of pounds are invested overseas. Meanwhile employment and living standards here suffer…

The British economy has not been kind to workers. The most significant economic legacy of the 2007-08 crash was a monumental pay squeeze. Wages flatlined for fifteen years, then inflation shot up. Pay battles over the past two years made some gains, eroded by a further rise in the cost of living.

Ministers used to claim that compared to other countries Britain hadn’t done badly in the total goods and services produced. This was true but is mainly due to population growth through immigration. Growing our economy simply by having more people does nothing for our key need – to raise living standards.

The infamous and elusive “green new deal” will not transform the labour market to save us from hardship. Social democracy, echoing the World Economic Forum, tells us that net zero transition will bring huge numbers of good green jobs. But instead, workers experience the destruction of good productive jobs at Port Talbot, Scunthorpe, Grangemouth and so on.

The key problem with the capitalist economy is under-investment. The solution is investment.

For the past four decades, Britain has consistently been among the lowest investors of OECD countries, generally in the bottom tenth. Fixed total investment has been the lowest in the G7, averaging just 19 per cent of GDP a year.

Debt

To disguise the capitalist aversion to investment in Britain, Labour’s Treasury now insists that public investment depends on public debt falling between 2028-29 and 2029-30. Treasury dogma under all governments has consistently opposed new public sector investment. That fell from over 5 per cent of GDP to below 1 per cent between the mid-1970s and the mid-1990s.

Potential investment opportunities are offered to private investors, who often fail to deliver. The capitalist class runs off with profits rather than invest them in Britain. Private investment, like public investment, is also lower in Britain than it is in any other G7 country.

We should be nurturing and expanding, not destroying, our areas of manufacturing expertise. Manufacturing industry is by far the main source of innovation, of producing better goods. It conducts 60 to 70 per cent of all research and development in Britain – the key to improving our productivity, which grew by just 0.5 per cent a year between 2010 and 2022.

But instead of investing to create new assets, too often British-based companies have taken on liabilities and sold existing assets. Foreign ownership of firms listed on the London Stock Exchange has increased to 56 per cent in 2020.

Energy

Britain needs to invest in producing energy. In 2013 Cameron told his ministers to “get rid of the green crap”. In practice this meant cutting back requirements on energy suppliers to install efficiency measures, such as cavity wall insulation. Installations fell by more than 90 per cent almost overnight – from over 2 million in 2012 to under 200,000 a year later. As a result, energy bills are far higher than necessary, and will continue to rise.

Britain needs investment in education. But spending for each pupil aged 16 to 18 has been gradually cut since 2013 – by 16-18 per cent for sixth forms in schools and colleges, and 8 per cent for FE colleges.

Since 2017, over 40 per cent fewer under-nineteens have started apprenticeships in England. The decline is 38 per cent for 19- to 24-year-olds. Between 2017 and 2022, employers funding or arranging any staff training during the previous 12 months fell from 66 to 60 per cent – and so on. The article “Not a skills shortage, more a training blockade" in Workers November/December 2024 edition sets this out in detail.

The British population was around 58 million in 1996; net inward migration was relatively stable. But in 1997 the incoming Labour government imposed its open door policy. All successive governments maintained a sustained increase in net migration; by 2021 the population had reached 67 million.

‘The key problem with the capitalist economy is under-investment. The solution is investment.…’

This enormous population increase has wrecked housing availability. Developers flock to rural areas, covering farmland and natural habitat in housing, now goaded on by Labour’s mandatory housebuilding targets across the country – to be enforced by reforms to the planning system. But we need investment in truly affordable housing in our inner cities. That is how rent and mortgages could be brought down for future generations and still retain our countryside.

Investment of £20 to £30 billion is needed to improve our housing stock, £50 billion to meet our energy needs, and £8 billion to improve our water supply. And then there are schools, hospitals and transport to add.

Over £6 trillion of long-term capital is held in our pension and insurance industries, so the capital needed for growth is available. We could use the £60 to £70 billion a year of tax breaks for annual pension funds to encourage investment in British industry.

Yet British pension schemes have cut their investments. Transport for London, for example, has a pension pot of £15 billion, but only 0.5 per cent of this is invested in UK stocks, while 33 per cent is in overseas equities. In 2004, it had 39 per cent in UK equities.

The government is sticking to Treasury dogma – cut spending, raise taxes, to “balance the books” – the rules which brought austerity before and will do so again. The present Chancellor says we can’t invest until we grow, which is like saying we can’t grow food until we eat. We can’t grow until we invest, just as we can’t eat before we grow food.